Ideally, revenue growth will be at least 20 percent per year (with many exceptions). Companies that are in the early growth stage need to generate continual revenue growth-especially if they are accruing negative profit. Revenue Growth: ultimately, revenue is what makes all other components of running a business possible.Some of the most important things to keep in mind include: Taking the time to review this information can help you determine which stocks are most likely to be underpriced in the status quo. If a company is publicly traded-whether on the NASDAQ, NYSE, or any other exchange-it will be required to disclose some basic financial information to the public. Selecting Microcap Stocks: Key Things to Look For But if you can clearly recognize the value the company provides, it is time to take a closer look at the business’s current financial status. When considering a prospective investment, begin by asking yourself, “How does this company create value?” If you can’t answer this question, you probably shouldn’t invest. To find profitable microcap stocks, you will not only need to know what the stock currently costs-anyone with an internet connection can figure that out-but also determine what the “correct” price ought to be. Ideally, investors will seek to identify assets that are underpriced in the status quo. A Value-Driven Approachīenjamin Graham, the author of the Intelligent Investor (Warren Buffett’s favorite book) once famously quipped “Buy not on optimism, but on arithmetic.” Essentially, Graham’s time-tested approach to investing involves carefully looking at the numbers and fully understanding what you’re purchasing.Ī good investment, whether in microcap stocks or anywhere else, is one that could be justified by much more than a “good feeling.” As Graham also stated, “You must never delude yourself into thinking that you’re investing when you’re speculating.”

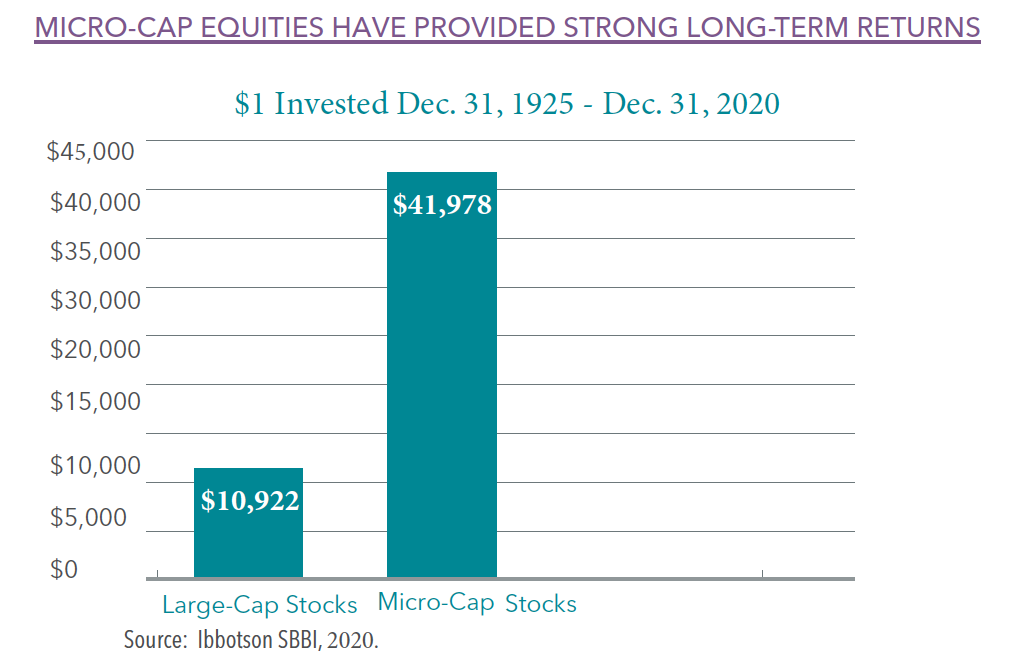

Microcap investing can be incredibly lucrative, but you will certainly need to know what you’re doing.īelow, we will discuss some of the most important things you need to know about microcap investing. With a high potential for returns, you will also be exposed to increased risk. Investors that are able to identify the right microcap stock selections can earn significantly higher returns than they’d be able to find in the more “popular” parts of the stock market.

Accordingly, they often have very high potential for growth. Microcap stocks are smaller, meaning they are typically experiencing the “growth stage” of the business cycle. These companies are a bit larger than nanocap stocks (microcap less than 50 million USD), but smaller than other publicly traded companies, including all the companies appearing on the major indexes mentioned above.

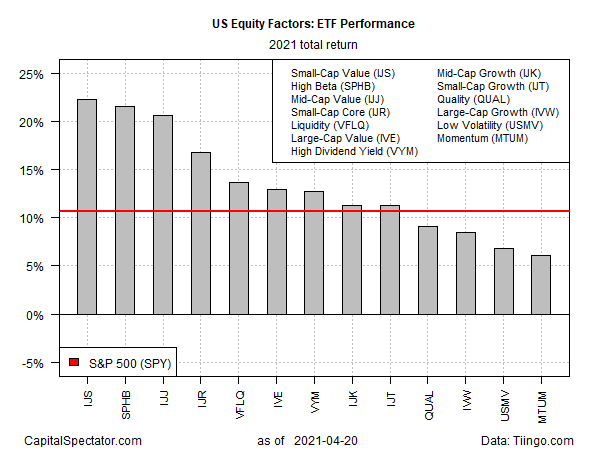

Microcap stocks are stocks that have a market capitalization between 50 million USD and 300 million USD. But while investing in these stable indexes typically perform well (averaging about 10 percent annualized ROI), they are really just the tip of the much larger investment iceberg and ignore the microcap market. These are two large indexes that account for many of the largest companies in the United States (and for that matter, the world). When people talk about the stock market, you will often hear them quote the S&P 500 and the Dow Jones Industrial Average.

0 kommentar(er)

0 kommentar(er)